Should You Save Money Or Invest

Should you save cash or invest?

5 minute read

We give you the lowdown on what to consider when weighing up whether to invest your savings.

Who's it for? Investors with basic investment knowledge

The value of investments can fall as well as rise; you might not get back what you invest. If you're not sure about investing, seek independent advice.

What you'll learn

- The purposes of saving and investing

- How you can make your money work harder

- Save for a rainy day, invest for your future.

When it comes to saving money and planning your finances, cash savings and investments are both important and each has a role to play.

Savings are ideal for short-term or unexpected expenses such as holidays or the boiler breaking down. But if you're looking to build your wealth for the future, it's worth considering investing because stock markets tend to perform better than cash over the longer-term.

However, this can't be guaranteed as stock markets fall as well as rise, so you could get back less than you invest, which is why a combination of both savings and investments can be a good thing to aim for – save for a rainy day, invest for your future.

Cash savings

Generally, cash savings are appropriate for goals that are less than five years away – maybe you're saving for a house deposit or are planning to get married, for example. Crucially, cash can provide peace of mind that your money won't suddenly fall in value just when you need it, which is important if you don't have much time to wait for it to recover.

It's also worth having some cash savings for a rainy day – when life presents an unexpected expense or your circumstances change and you need to access money quickly. The amount you'll need will depend on you and your circumstances – consider factors such as what your monthly outgoings are; whether you're the sole earner in the household; how long you think it would take to find a new job if you were to lose yours. For one person, having three months' salary will be enough but someone else might feel more comfortable with a year's salary.

Many savings accounts allow you to take money out whenever you want, though some don't permit withdrawals for a certain period of time. These tend to be the accounts that pay the highest rates of interest so this is worth bearing in mind when comparing savings rates.

Once you've built up your rainy day savings and have enough to cover those short-term goals, you might then want to consider investing because while low risk, cash is by no means risk-free. You won't lose money in cash but it often struggles to keep up with inflation – rising prices – so your spending power can fall over time.

However, before you commit your money to the stock markets, there are a few other things to consider. While you don't necessarily have to be debt-free, you're probably not ready to invest if you've got money outstanding on credit cards and loans or are regularly overdrawn so look to pay those down first.

Also, don't overlook protection insurance: life insurance, critical illness cover, and income protection are all important things to consider because your savings and investments would only go so far if your income was suddenly to stop. If you're not sure which protection option is right for you, seek independence advice.

Investing

If you're planning your finances for the longer term – five years or more – investing offers the chance to get your money working harder because you should get better returns than you could from cash.

There will be periods when the stock markets fall, but there will also be periods when they'll rise and the longer you keep your money invested, the more time it has to grow which reduces the risk of your investment falling in value.

It's therefore worth considering for financial goals that are some way off, such as retirement and children's education costs. And even if you don't have a specific goal, investing can help in terms of building your wealth to provide you with greater financial security.

As well as time being a key factor, diversification is also important when it comes to investing.

When starting out, it's common for people to buy shares in a single company. However, this is quite a high risk strategy because your fortunes are dependent on the performance of that one company. It's therefore important to diversify and spread your money between different companies, sectors, geographical regions, and also different asset classes. That way, even if one company doesn't perform very well, others will be doing okay. While not eradicating the risk completely, diversification can reduce the chances of you losing money.

You can do this yourself by buying different shares and bonds, but a simpler way is to invest in a fund, where your money is pooled with that of other investors and invested in multiple companies.

Cash v Investing – the returns

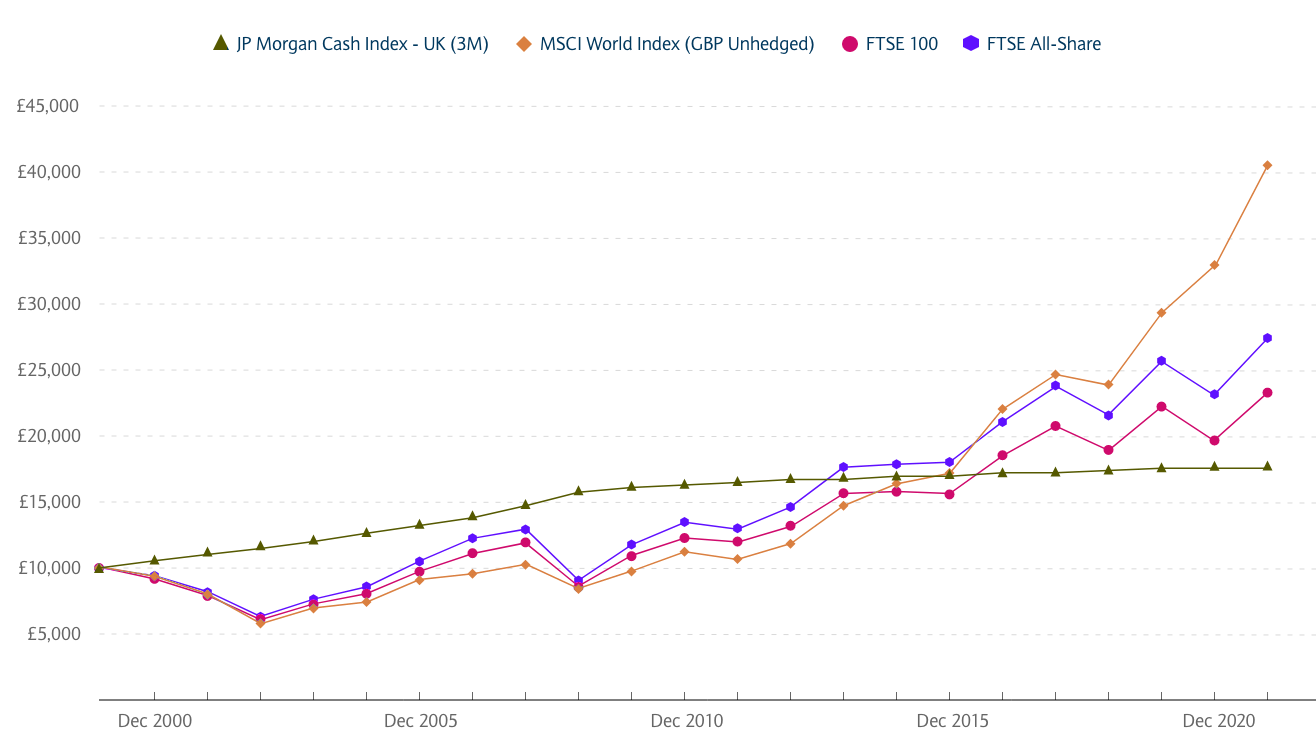

Over the period from January 2001 to end of December 2020, holding cash would have produced very different returns compared with investing in shares or bonds. You do need to bear in mind that the past performance of investments is not a reliable indicator of their future performance. But here is what would have happened if you had started with £10,000 in January 2001.

Total returns over the 20 year period

If you started with £10,000 in January 2001, here's how much it would have been worth by 31 December 2020:

It's important to note that past returns aren't an indicator of what will happen in the future and there have been periods of time when returns from cash have been higher than those of the stock market.

For example, as the graph below shows, in the early part of the period which included the the tech bubble burst in 2000 and the bear market that followed, stock markets suffered significant losses, some of them falling spectacularly. Many of those who invested just before the markets started falling in 1999 would have seen their portfolios drop in value, while those who kept their money in cash could have seen higher returns.

Ready to invest?

The decision of whether to hold cash or invest is down to you and your long-term goals. The choice between saving and investing should be based on your individual circumstances and your life plans and ambitions.

You may also be interested in

The value of investments can fall as well as rise. You may get back less than you invest. Tax rules can change and their effects on you will depend on your individual circumstances.

View the accessible version of our graph

-

Date JP Morgan Cash Index - UK (3M) MSCI World Index (GBP Unhedged) FTSE 100 FTSE All-share Dec 1999 £ 10,000.00 £ 10,000.00 £ 10,000.00 £ 10,000.00 Dec 2000 £ 10,650.50 £ 9,367.42 £ 9,176.72 £ 9,409.87 Dec 2001 £ 11,243.02 £ 7,997.02 £ 7,883.68 £ 8,159.16 Dec 2002 £ 11,716.83 £ 5,791.88 £ 6,135.74 £ 6,308.42 Dec 2003 £ 12,163.90 £ 6,933.12 £ 7,233.64 £ 7,624.36 Dec 2004 £ 12,733.64 £ 7,416.21 £ 8,047.21 £ 8,603.28 Dec 2005 £ 13,357.21 £ 9,080.52 £ 9,719.81 £ 10,499.65 Dec 2006 £ 14,000.25 £ 9,563.43 £ 11,122.00 £ 12,258.47 Dec 2007 £ 14,856.98 £ 10,252.30 £ 11,941.11 £ 12,910.14 Dec 2008 £ 15,881.87 £ 8,415.59 £ 8,558.23 £ 9,046.29 Dec 2009 £ 16,232.73 £ 9,739.57 £ 10,896.80 £ 11,770.85 Dec 2010 £ 16,387.03 £ 11,227.33 £ 12,272.50 £ 13,479.39 Dec 2011 £ 16,586.27 £ 10,684.12 £ 12,004.76 £ 13,012.91 Dec 2012 £ 16,816.42 £ 11,831.41 £ 13,202.03 £ 14,614.08 Dec 2013 £ 16,908.52 £ 14,709.36 £ 15,665.87 £ 17,654.84 Dec 2014 £ 17,012.68 £ 16,395.77 £ 15,781.28 £ 17,862.90 Dec 2015 £ 17,128.02 £ 17,194.09 £ 15,572.72 £ 18,037.71 Dec 2016 £ 17,247.19 £ 22,049.70 £ 18,543.18 £ 21,059.59 Dec 2017 £ 17,317.65 £ 24,652.63 £ 20,759.02 £ 23,817.85 Dec 2018 £ 17,467.64 £ 23,903.63 £ 18,945.79 £ 21,561.62 Dec 2019 £ 17,638.30 £ 29,339.46 £ 22,227.12 £ 25,693.94 Dec 2020 £ 17,745.53 £ 32,955.36 £ 19,660.31 £ 23,171.82

Important information

-

Transferring ISAs doesn't affect their tax-efficient status, but you should make sure that you don't have to pay penalties or give up valuable benefits – make sure you understand the risks and drawbacks involved in this.Return to reference

Should You Save Money Or Invest

Source: https://www.barclays.co.uk/smart-investor/new-to-investing/before-you-start/should-you-save-cash-or-invest/

Posted by: ledfordsholebabluch.blogspot.com

0 Response to "Should You Save Money Or Invest"

Post a Comment